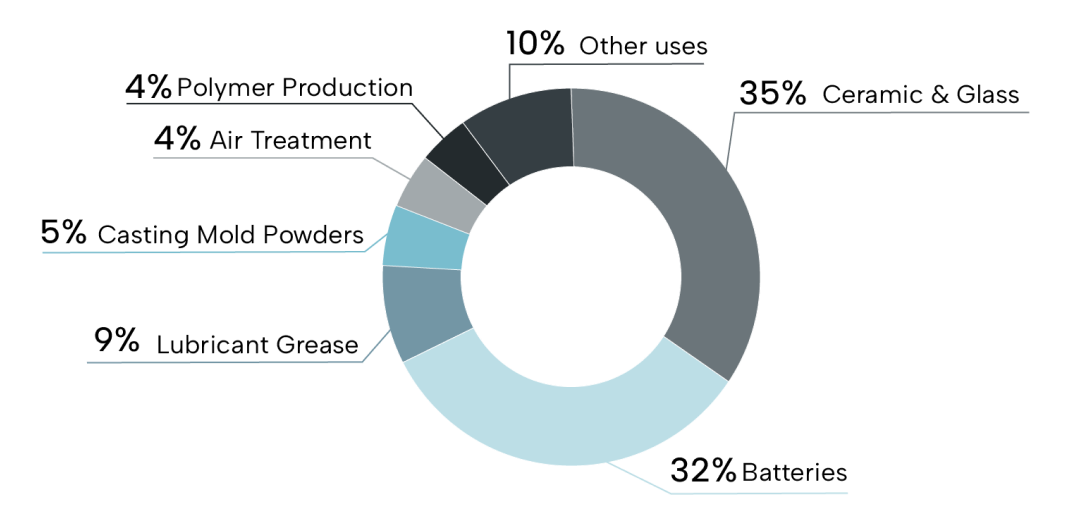

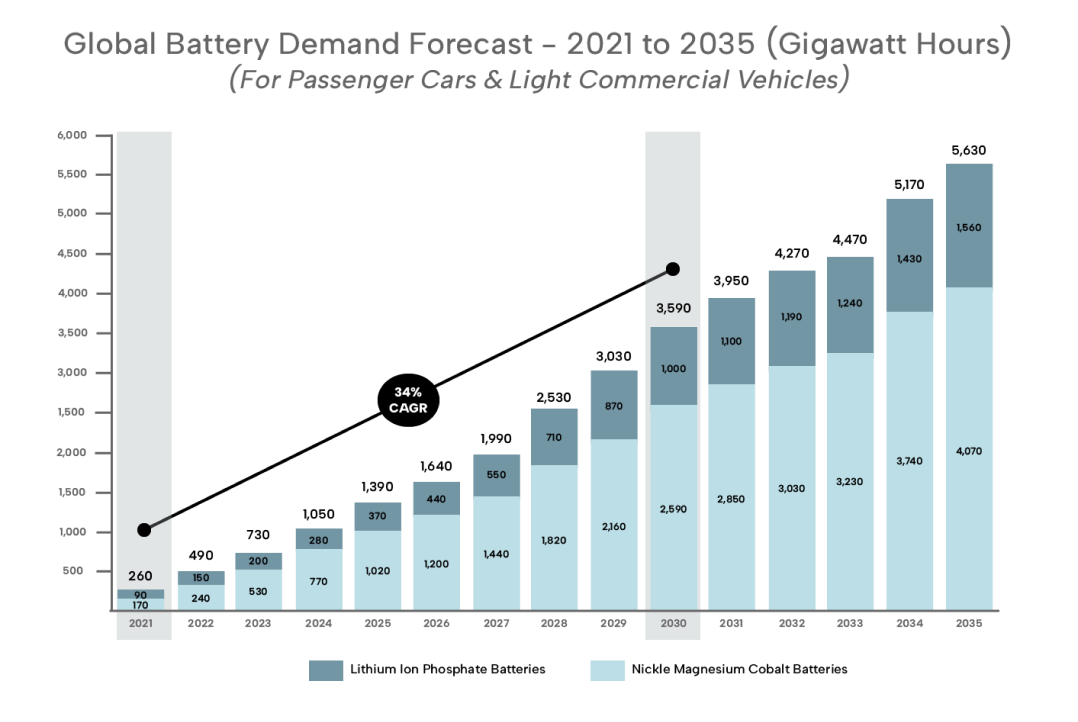

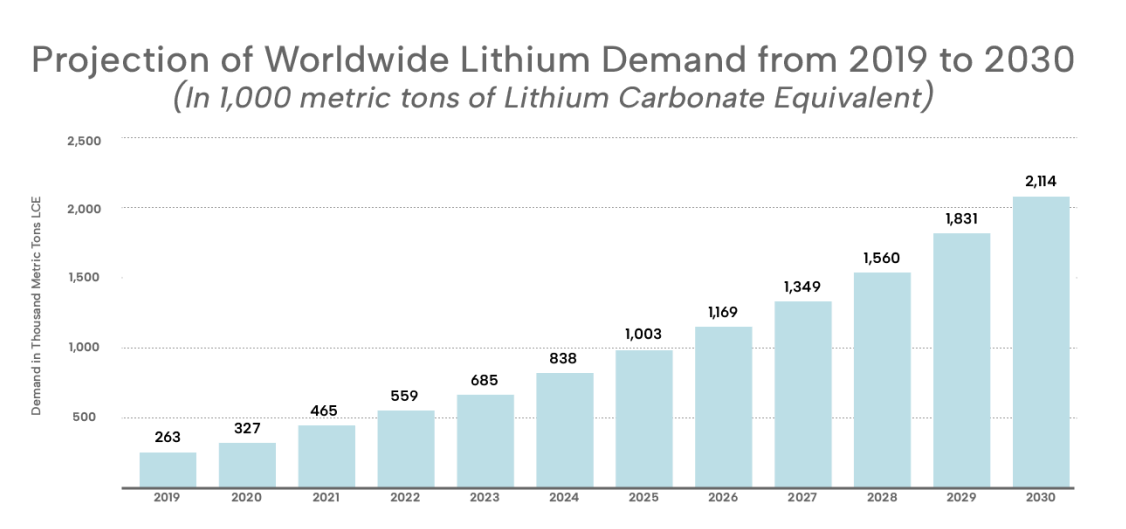

With growing concerns around carbon emissions, the world continues to rapidly shift towards electrified transport. Lithium is one of the key components in electric vehicle (EV) batteries and global supply continues to remain under pressure due to rising demand. According to the International Energy Agency (IEA) there’s a strong possibility of a global lithium shortage by 20251, with the IEA estimating approximately 2 billion EVs will need to be on the road by 2050 for the world to achieve net zero carbon emission target, with the automotive industry straining to meet demand. The lithium market is experiencing an expansion unlike any other commodity. The driving forces behind this unprecedented demand can be found in the growing demand in the electric vehicle market, high-capacity energy storage, increasingly powerful and compact smartphones and other handheld devices. Due to a supply shortage from limited projects, the lithium price has seen a threefold increase between 2021 and 20222. At present, around two-thirds of global consumption is used in ceramics, glass, polymers and alloys, however this is set to change in the coming years, with the demand for batteries expected to increase by more than 400%3. The EV battery market is dominated by two main battery types, and while both use lithium, the cathodes have different compositions. An NMC battery uses lithium, manganese, and cobalt oxide as cathode material, while LFP uses a lithium iron phosphate chemistry. Both battery types utilize a graphite anode. The most relevant battery chemistry remains NMC, with about a 70% market share, while LFP remains relevant at around 30%. (Nickel-cobalt-aluminum (NCA) batteries are similar to NMC and currently only used in higher-end performance variants of the Teslas.5) Source: Gigafactories & Raw Materials, PWC, August 2022: https://www.pwc.com/id/en/publications/cips/automotive/gigafactories-and-raw-materials.pdf The global demand for batteries is estimated to grow by approximately 35% CAGR to 3.6 Terawatt-hours from 2022 to 2030. Market growth is predicted to be driven by both an increased Battery Electric Vehicle (BEV) sales share in the automotive market and increasing battery size and capacity in the vehicles6, with a single car lithium-ion battery pack (of a type known as NMC532) containing around 8 kg of lithium, according to figures from Argonne National Laboratory. Global EV purchases jumped to 6.6 million in 2021 from 3 million the previous year, making the EV market share around 9%, according to the IEA. Factoring in market growth, this shows a decline of non-EV sales of about 700,000 units. However, the entire lithium market is set to expand also, with current non-battery applications anticipating growth along with global population, advances in electric storage solutions and as yet unrealised applications. Most lithium mining is concentrated in Latin America and Australia, while China controls most of the processing capability. Production of lithium chemicals and end-products spans countries like China, Japan, and South Korea. Even when trading with allies, the lithium supply chain is truly global. The U.S. ability to manufacture batteries currently relies on factors outside its control — global trading prices, foreign mining and processing capabilities. However, the U.S. is looking to secure as much domestic supply as it can. The U.S. announced $2.8 billion in grants in October 20227 to expand U.S. production of electric vehicle batteries, with some of this award to suppliers of major auto companies. The president also announced the American Battery Materials Initiative, a whole-of-government effort to secure a reliable and sustainable supply of critical minerals used in EVs. These economic initiatives aim to have electric vehicles make up 50% of all vehicles sold in the United States by 2030. The domestic production policies have ignited domestic manufacturing of EVs, EV chargers and batteries, aiming to make new and used EVs affordable for consumers and providing the auto industry market certainty8. About half the world’s lithium comes from groundwater brine. Accessing this lithium involves pumping the water to the surface and letting it sit in ponds for months or years until the lithium concentration is high enough. These processing facilities are highly specialized, as different customers require compounds with specific compositions and purities. Most lithium processing facilities are in China, which produced over 60% of the world’s lithium in April 2019. This means the supply chain of a lithium battery truly depends on global trade, even if the manufacturing facility for the battery itself is in the United States. Loyal Lithium is strongly positioned to benefit from being proximate to the producers of lithium-intensive products such as batteries. Coupled with new U.S. mandates to secure domestic supplies of lithium and other critical minerals, and an experienced team of executives and resource experts, Loyal Lithium stands to generate considerable value for partners and shareholders. The Inflation Reduction Act signed into law on August 16, 2022 by President Joe Biden, will inject hundreds of billions of dollars into clean energy and electric vehicle incentives and programs. The Act establishes a “two-part clean vehicle credit” and conditions the two-part credits on a certain percentage of materials used in a vehicle’s batteries being extracted, processed, manufactured and/or assembled in the US or in certain US-allied countries, such as. Australia & Canada. To qualify for the first $3,750 credit, a percentage of the value of applicable critical minerals contained in a vehicle’s batteries must be extracted or processed in the US, or in a country with which the US has a free trade agreement, or must have been recycled in North America. Applicable percentages increase from 40% prior to 2024, to 80% after 2026. Qualifying critical minerals include aluminum, cobalt, lithium, nickel, and graphite, among others. To qualify for the second $3,750 credit, a certain percentage of the value of the battery components in an EV must be manufactured or assembled in North America; applicable percentages increase from 50% prior to 2024 to 100% after 2028. Further, after calendar year 2024, a clean vehicle will not qualify for the tax credit if it contains any critical minerals that were “extracted, processed, or recycled by a foreign entity of concern” – including companies owned by, controlled by, or subject to the jurisdiction of the government of the People’s Republic of China. After December 31, 2023, a vehicle may not qualify for the credit if any “components” contained in its battery are “manufactured or assembled by a foreign entity of concern”.Lithium Overview

Lithium and Electric Vehicles

Lithium Market Overview

LITHIUM BATTERIES

The Lithium Supply Chain

Loyal Lithium in the Mix

Lithium is Now Political